Comparative Analysis of

Forms in Car Insurance Quotes

-

"Get a Quote. It's fast and easy!"

Car insurers lure customers with promises of big savings and easy quote calculations. To see if the process is in fact that easy, we've compared how the leading US insurers designed their online forms to collect customers' data necessary to present a quote.

Bad Customer Experience with Forms Can Crush Performance in Digital Channel:

-

1Reduced Conversion and

Increased Cost Per Lead -

2Increased Costs

of Telephone and Chat Support -

3Lower Intel to Calculate

a Competitive Quote

-

-

42

On average, the US customers looking to get a quote need to fill in 42 form fields before they even see the price.

Number of Form Fields Before Quote Is Presented:

Click bars to see all questions asked by an insurer.Insurers Use APIs to Reduce The Number of Required Form Fields

-

5x5 out of 11 insurers attempt to find customer's car description using provided address. It reduces the form length just by four questions, assuming customers want to insure a single car.

-

1xOne of those insurers also used public records to find people living at the provided address and required to confirm if they actually live there.

-

-16Insurers in US and UK use similar APIs, however in the US they as 16 questions less on average than their British counterparts as revealed in our UK report.

-

-

No, Quotes Are Neither Fast Nor Easy

A recent PwC study found that 36% of customers surveyed felt that they would need telephone support at hand if they were to purchase [non-life insurance] online.

Do Insurers Offer Telephone Support?

-

8x8 out of 11 Insurers present a customer with the service phone number in a prominent place where customers can easily find it.

-

2xOnly two companies clearly informed customers if the phone support was currently available.

-

1xJust one company promoted their customer service as operating 24/7.

-

-

What Questions Are Insurers Asking

Using Online Forms?The majority of questions is related to the driver's address and contact details. Surprisingly, it seems that the details of current insurance are more important for the insurers than the driver's background.

Total Number of Questions By Category

Click bars to see questions in each category.How Many Questions Insurers Ask Per Category?

Click bars to see questions in each category.Just 6 out of 82 unique questions were asked in all of the reviewed insurance quotes and 18 in more than 75% of quotes which shows that online quotes aren't well standardized in the industry.

Percentage of insurance quotes containing a type of a question.

Click labels to see actual questions.-

The Art Of Asking About Sensitive Information

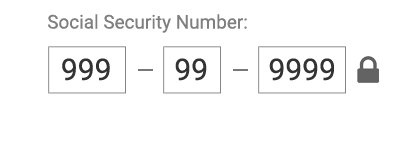

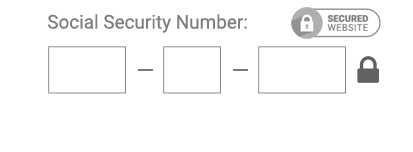

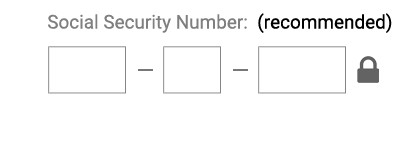

In order to provide a quote, insurers need to ask customers to provide sensitive information. If asked in a wrong way, such questions can be a deal-breaker. Social Security Number is a great example of challenges involved with designing forms.

How Insurers Reassure Customers of Their Security?

-

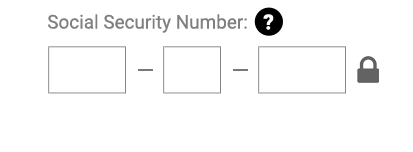

6x6 out of 7 companies that asked for SSN added a lock icon next to the field.

-

2xTwo companies added a badge of a well known security brand (VerSign, Norton Security) next to the field.

-

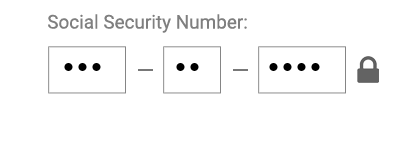

2xTwo companies used "password" type input field to mask entered value.

The transmission of sensitive data might be secure, but some customers will not provide sensitive information unless they know how it is going to be used.

How Insurers Explain to Customers Why They Require Sensitive Information?

-

3xThre companies hid explanation why they need SSN under a tooltip or didn't provide it at all.

-

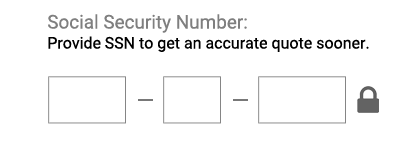

3xThree companies briefly explained vague benefits of providing the SSN, that is a faster or more accurate quote.

-

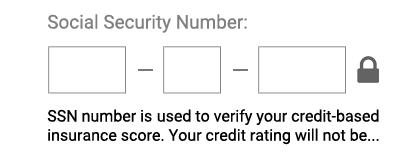

1xOne company actually explained how Social Security Number will be used - to obtain credit-based insurance score.

Regardless how well a field is described and designed, some customers will decide not to provide sensitive information and abandon the form if such information is required of them.

Do insurers require customers to provide Social Security Number?

-

4xIn four quotes, designers did not provide a clear hint if a field is required or not.

-

2xIn two cases, Social Security Number field was marked as optional.

-

1xIn a single quote, a field was labeled as recommended to complete.

-

-

Digital Sales or Lead Generation?

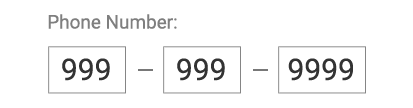

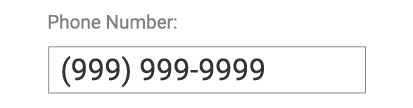

Another example of the question that is known to reduce conversion is a phone number. Yet, insurers are asking for it anyway. Why? Because substantial portion of online quotes is converted by agents over a phone.

Is phone number required in order to get a quote?

-

10xIn 10 out of 11 quotes, the customers are asked to provide a phone number before the quote is given.

-

4xIn four cases, the phone number field was explicitly marked as optional.

-

1xJust a single company decided not to ask for a phone number prior to presenting a quote.

What Contact Details Are Customers Asked to Provide?

Unlike in Europe, insurers in the US do not give customers an option to opt-out from receiving offers.

-

-

Form Design Lacks Standards

Insurers formulate questions in many different ways, use different form controls, or even require data to be entered in different formats. That must be confusing for customers trying to get multiple quotes.

-

6x"Age first licensed...?"

-

1x"Years licensed?"

-

1x"Have you been licensed to drive less than 3 years?"

-

5xFive companies used a single input to collect the date of birth. One of them required "-" instead of "/" as a separator.

-

5xFive other used a set of three separate input fields for month, day and year to avoid issues with the date format.

-

1xA single company used a select option form field for month selection

-

5xHalf of companies used a set of 3 inputs to ask for a phone number.

-

5xA single input field was equally popular.

-

1xAgain, there was no consistency in the required format of the data to be entered.

Inconsistency in the format and number of fields used to collect a single data point can make customers' journeys even more complex if they are using browser's auto-fill functionality.

-

-

How to Build Forms

Dropdowns, Inputs, Radio Groups and Checkboxes.

When to Use Which?If you require users to fill in such a large number of form fields, make sure your choice of controls is right.

Form controls used by insurers to ask certain questions.

Click a label to see how questions and answers differ for different form controls.Disclaimer: The selection of insurers was based on their market share and specification. Number of fields was determined following the most basic scenario in which a potential customer was looking for a single car quote, had no accident or offence history and was the only owner and driver. Data for this analysis was obtained from hired panelists using the same details on each of the websites in June 2016 and compiled in July 2016.

Call us:- United States +1-866-732-8150

- United Kingdom +44-2030-867-221

- Poland +48-6612-77-770

Better Forms = Higher Conversion

We help fix forms and optimise conversion in ecommerce, banking and insurance. Let us show you how you can and should analyse your forms.

Book Live DemoRequest Live Demo

Could you please describe briefly how research and optimization work at your company? It will help us prepare for the demo.

"a grander vision"

HQ: Use It Better, Leborska 3b, 80-386 Gdansk, Poland.

Thank you!

We will contact you soon.

-